Welcome: Be sure to watch the video below now.

A Tale of 2 Mortgage Originators…

(Which one are you?)

(*TRAINING VIDEO TRANSCRIPT BELOW)

A TALE OF TWO MORTGAGE ORIGINATORS

This story is an example of how two mortgage originator paths lead to very different results.

I talk to dozens or originators every week and these are the choices I see them make.

As a result, I wanted to share how the outcomes differ so originators can make better informed choices.

For the sake of this example I am going to call the originators TJ and JT.

You can see they are opposites as are a few of the choices they will make.

The results are representative of the types of outcomes from these choices.

I am Tim Scholten.

I m a 30 year banker. I have done almost everything in banking you can imagine. I built some of the most highly successful and innovative teams for a top 20 bank in the US. In 2008 I started helping community banks during the financial crisis and became a growth and turn around specialist saving banks ready to collapse and helping others return to profitability. Now I am helping mortgage originators like you with our Million Dollar Originator (MDO) programs that I built to help banking clients across the US.

TJ is an originator that has been in the business for about 6 years.

She has been averaging from $65,000 to $75,000 per year in income.

She puts in a full day of work every day, but all the tasks that a mortgage originator needs to do at a small community bank quickly eat away at her day.

She has a good back-office team supporting her.

Loans consistently get closed in a timely fashion.

Falling rates

24 Refinance opportunities

Individual contacts

TJ’s OPPORTUNITY

Rates recently fell creating a refinance opportunity.

She came up with a list of about 2 dozen customers that would benefit from a refinance.

She had great intentions about calling them all and helping them save money, but clients were difficult to reach and after a few calls things got busy.

She got one refi in process for a client in addition to her other purchase business.

This would mean about a 20% increase in income for her for the month.

TJ’s PROCESS

5 Contacts made

3 Refi’s in 90 days

Too busy working to make contacts

TJ was completely committed to personalized service.

She ran the numbers for every client before calling them so she knew exactly how each client would benefit from a refinance.

The process was slow, doing all the analysis up front, but there was no risk of contacting a client that might not benefit by from a refinance.

Unfortunately while she was delayed in making contact with most of her list, rates went back up.

She was only able to reach 5 clients before rate moved back up.

TJ’s process was slow and labor intensive….but rewarding finding opportunities to help people.

But most people were never helped.

The hard work that most originators put off is making the calls.

The work that really matters.

Analysis on all prospects

No contact without all the facts

Rates went back up

TJ’s OUTCOME

Because TJ spent most of her time on analysis instead of making contact with her prospects, she was only able to reach 5 of her 24 prospects.

Three months in she had only closed 3 deals.

While she felt good about the ones she had helped, but rates moved back up and the benefit disappeared for the remaining 19 prospects.

TJ had 3 satisfied clients and made an additional $5,000 that quarter.

In another town and another state, JT is a loan officer that has been in the business for about 2 years.

She too was making around $75,000 per year working for a community bank.

For JT this was a pretty good income given that she had worked for the bank in a hourly role prior to becoming an originator, making about $38,000 per year.

JT’s OPPORTUNITY

Falling rates

27 Refinance candidates

Recognized she needed help

When rates took a dip, JT also recognized that he had clients that would benefit from refinancing their mortgage.

She Identified 27 prospects that would benefit so she knew he needed a good contact gameplan to make sure she reached all of these prospects in a timely fashion.

That is when she contacted us for support to help her figure out the best approach.

JT’s PROCESS

-Implemented automation

-Contacted all clients multiple times over 2 weeks

-Used voicemail, text and email contacts

Here is how we helped JT.

We worked out the average benefit to her client list.

There were obvious variances, but we assured her that communicating with averages made sense.

The details would be worked through in the process of dealing with each interested prospect.

We then helped JT set up our automation service so she could use ringless voicemail, text messages and email to make her entire list aware of the opportunity to save money.

We got her text and email messages created and her voice messages recorded, loaded up her list and in about a hour, she was ready to start making contact.

The system started doing the outreach in her voice with automatic follow up via text, letting the client know that she had left an important message for them.

Then later the system followed up with an email that included additional detail.

JT’s OUTCOME

-Made NO outbound contacts

-Refinanced 22 Clients in 90 days

-Earned $44,000 additional income for the quarter

JT didn’t make a single outbound contact.

She waited just minutes before her clients started contacting her, asking for details and help getting their loans refinanced.

Her problem became fielding all the contacts from clients that were interested in her help. In short, 22 of the 27 were interested and would benefit from a refinance.

JT had a really busy 3 month period where she helped all 22 of her interested clients refinance their loans in addition to her normal purchase business.

Refinances were processed on a first come, first serve basis, with purchase business given the priority.

She got all 22 refinances done over the 90 day period. This allowed her to boost her annual income by over 40% without chasing a single client.

Customers were satisfied and saving money.

They felt a real connection with JT and felt like she was really watching out for their best interest.

The bank created more loyal customers and made a substantial amount of added income from the refinance volume, and JT and her family made an additional $44,000 that quarter.

-Extra $5K

-Extra $44K!

-RESULTS COMPARISON

So let’s compare. TJ’s results with JT’s results.

TJ used traditional methods to make personal contact with her prospects.

She was able to get 3 clients refinanced in about 90 days in addition to her purchase business.

She spent hours getting ready to make contact by reviewing each clients file and had the details for each client mapped out in advance.

Then she began making contact by phone.

Unfortunately she got busy with phone tag, emailing details to clients, and her regular activities pulling purchase deals together.

Her outreach effort only benefited 3 clients and over 90 days she was able to earn about an extra $5,000.

Most of the clients on her list were never contacted and didn’t benefit from the rate savings as rates edged back up.

Some may have gone elsewhere for a refinance since there are plenty of proactive originators out there.

In contrast, JT spent about an hour implementing our automation solution to make all that contacts for her.

She shared average info with her refinance prospects and let them decide if they were interested in proceeding.

Almost all of them replied back to her over a 2 week period, and a few trickling in later, allowing her to schedule appointments and get 22 refinance deals processed in 90 days.

She didn’t waste time on up-front analysis or chasing clients.

She just used automation to do the outreach so she could stay focused on processing loans and helping clients that were interested.

In the same timeframe as TJ, JT was able to help almost 10 times more clients and make almost 10 times more money.

They both had similar opportunity with very different outcomes.

What about you?

Are you stuck like TJ doing business the old fashioned way?

Here is the painful truth.

Automation isn’t all that new.

Good originators are using tools like this to automate pieces of their business and create new capacity and close more business.

The smart ones are closing more business than most of their peers.

Isn’t it time you took a look at your business to see how simple tools like this could enhance your client outreach and automate much of your client follow up?

I can save as much as 35% to 40% of your time.

Here is how it works.

We use proven messages delivered in a way that feels personalized and ensures that the information reaches your clients and prospects when needed.

You can stop chasing clients and let the automation do all the heavy lifting for you.

You simply respond to clients that are ready to take action.

Do you see how smart that is? How it can help you leverage your time to grow your business?

How you can reach out and stay in touch with so many more clients and prospects that you can with the old fashioned smiling and dialing?

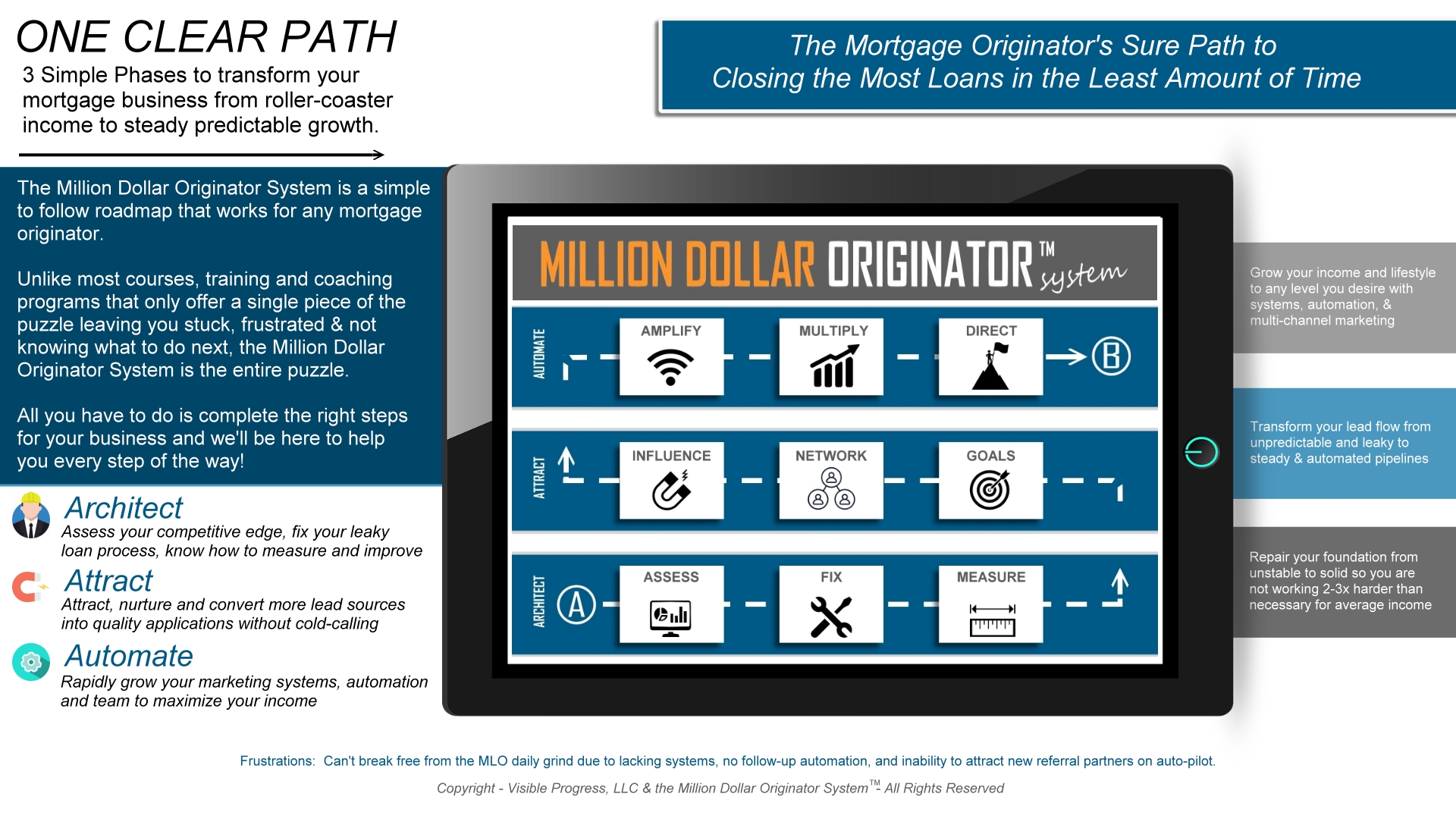

Our Million Dollar Originator System shows you where you are on your journey to the top.

Once you know where you are, you can clearly identify the next step you need to take to advance up the profit pyramid.

Where are you on your journey versus where you would like to be?

Take a minute and see where you land.

As powerful as this solutions like automation are in creating a consistent flow of leads for you and saving you up to 2 full days of your week, this is only 1 step in the 9 step process that every top producing originator across the country has mastered.

Miss just 1 of these steps and your mortgage operation won’t produce or scale like it should.

You’ll never reach your peak potential.

You’ll remain stuck where JT is.

The Million Dollar Originator system has 3 success lanes, from architecting the right foundation for your business so that it can scale effectively as you grow, to helping you attract an ever increasing flood of prospects and applications, to automating and scaling your business multiple times over, from a solo originator to a true business owner.

The Million Dollar Originator system gives you one clear path to follow to build your business from a beginner to a top producer. It isn’t just a piece of the puzzle you need to succeed, it IS THE ENTIRE PUZZLE.

The complete roadmap for your success.

The Million Dollar Originator or MDO system makes it super simple and clear to know exactly where you are on your journey to the top, and the 1 thing you need to master to reach the next level of success.

We have helped mortgage originators of all experience levels identify and overcome the roadblocks and often hidden barriers to their success so they can break through to that next level.

We’ve helped originators put lead generation and follow up on auto pilot giving them back as much as 2 full days per week previously spent chasing, prospects, clients and realtors.

This is time they can now spend helping people with real loan needs and closing more deals.

With the MDO system there is one clear path to increased success.

If you are seeing opportunities like TJ slip through your fingers because you have simply run out of time, or if you feel like you are ready to take your business to the next level, our 9 step roadmap will help you get crystal clear on what you need to do to make that growth a reality.

www.MillionDollarOriginator.com/call

To get crystal clear on what steps you need to take to advance your business to the next level, schedule your free, 30 minute strategy call with us.

On this call we help you identify the top 3 things you must do to advance your business.

If you want help fast-tracking your personal success, if you’d like to get 2 full days per week of your time back, and if you’d like to cut 3 to 5 years of pitfalls and frustration off your learning curve, schedule a free ½ hour strategy call with us.

After the call, we’ll simply ask you if you’d like to join our group consulting, take advantage of our done for your service, or if you want to implement your strategy on your own.

The choice is yours. Book your call now, you don’t have to wait.